Budgeting Apps to Replace Mint

×

×

Routing: 302076017

Routing: 302076017

Routing: 302076017

Routing: 302076017

×

×

Banking During COVID-19

The COVID-19 pandemic has forced many banks and credit unions to temporarily close the doors to their branches. While many continue to serve their customers as safely and efficiently as possible at the branch itself, mobile banking is a safe way to complete your banking needs.

Mobile banking is simply using an app on a mobile device, like a phone or tablet, to access bank accounts and perform transactions. It’s a service provided by a financial institution and is usually available around the clock. The features of the app drive what transactions are available to the user, but there are common features available through almost all mobile banking apps.

Almost every bank and credit union has some kind of internet banking solution such as a website, app, or, most often, both. These solutions are shockingly robust. While the face-to-face experience at your bank or credit union is most likely unmatched, mobile banking can offer many of the same or similar services. Common services include viewing your account balances, making transfers, paying on loans, and depositing checks.

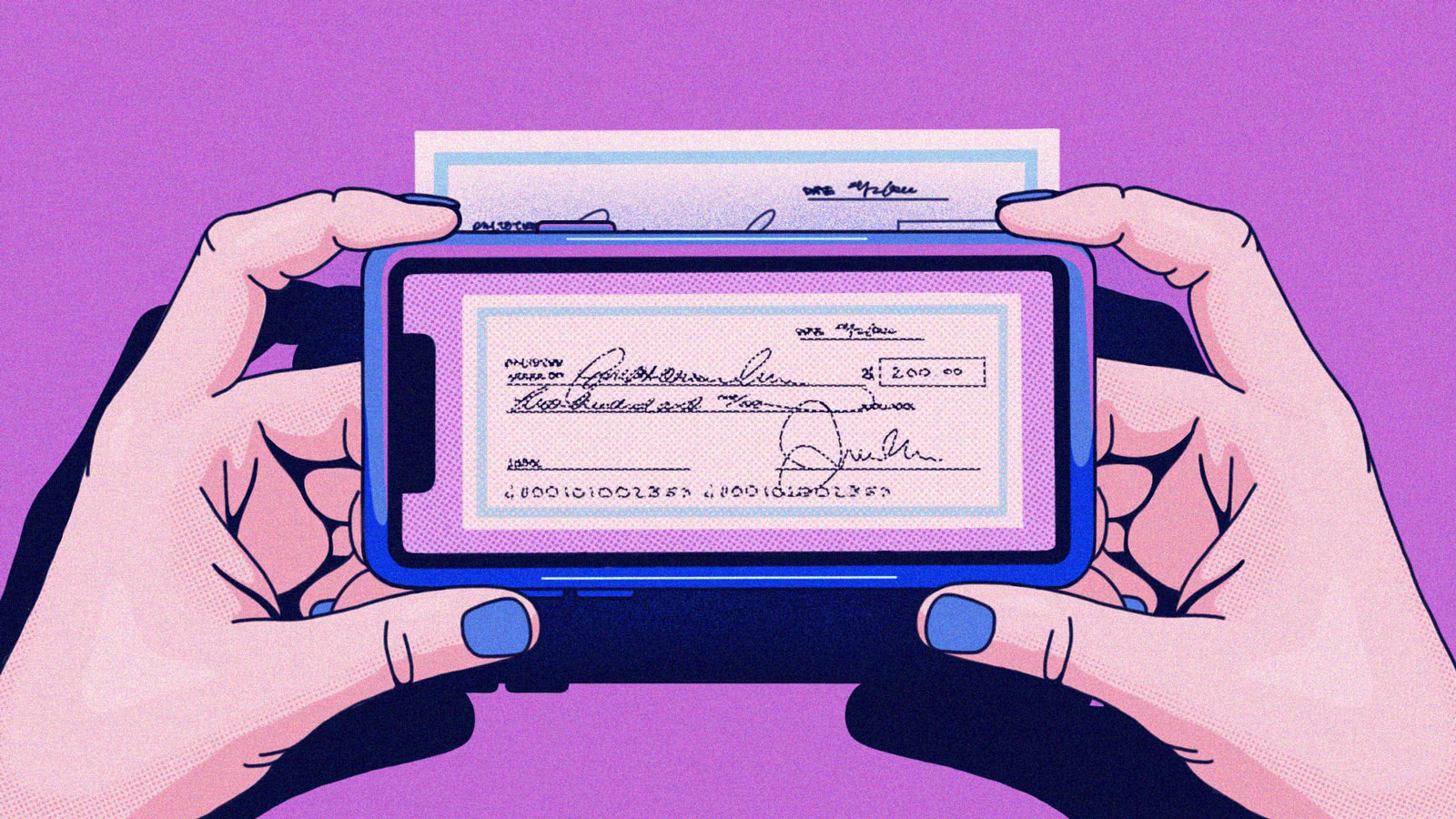

One potential service available through mobile banking is the ability to deposit checks remotely; this is called a mobile deposit. Though cash deposits have to be made at the branch, you can often deposit checks into your account with your mobile device. Financial institutions use remote deposit capture to deposit a check remotely—just snap pictures of the front and back of a signed paper check through the app. Remote deposit is convenient and easy, but follow the instructions in the app carefully and hang onto the check for a few weeks just in case there’s a problem with the deposit.

Image of individual depositing a check through mobile banking.

Through an app, you can quickly and securely transfer money between accounts. This means you can pull money from checking and put it into savings or even another checking account. If you have a home, auto, or personal loan through the same bank or credit union as your checking/savings account, you can easily make payments remotely by transferring money from your checking or savings to the loan directly.

Mobile banking often allows you to view statements right on your phone. You can open a statement to quickly access your account number or balance your checkbook. Often, you can download the statement if you need to print it or use it to apply for a loan.

Banks and credit unions work tirelessly to keep their internet banking options as safe and secure as possible. Many apps and websites will use two-factor authentication and others will use fingerprint or face scans to ensure that only you can access your accounts.

Another key aspect of cybersecurity in mobile banking comes from encrypting data. A secure system encrypts the data transmitted through wifi or radio waves as well as any stored data.

Of course, you should also take steps to keep your account secure by using a unique password and only accessing mobile banking on secure networks. If you have any questions, talk to your bank or credit union for their recommendations on how to best protect yourself when using mobile banking options.

Mobile banking is a powerful tool that makes managing your finances easier and more convenient. Manage your account worldwide with free Online and Mobile Banking and free eStatements from Sooper Credit Union. In the U.S. funds are accessible at nearly 30,000 surcharge-free CO-OP ATMs and over 5,600 CO-OP Shared Branch locations.

*This article is brought to you by Banzai.

Sooper Credit Union empowers members to take charge of their lives and to achieve their goals. You'll find both innovative thinking and tried and true strategies in our Empowered Living toolkit.

Open an AccountAt Sooper Credit Union, we are committed to providing a website that is accessible to the widest possible audience in accordance with ADA guidelines. We are working to increase the accessibility and usability of our website for all users. If you are using a screen reader or other auxiliary aid and you encounter difficulties using the website, please contact us at (303) 427-5005 or (888) SOOPER1 for additional assistance. Products and services available on this website are available at our corporate office located at 5005 West 60th Ave Arvada, CO 80003.

Sooper Credit Union Copyright © 2024

Insured by NCUA | Excess Share Insurance | Equal Housing Opportunity | NMLS# 422866

The ESI program provides up to an additional $250,000 of insurance once a credit union members’ balance exceeds the coverage provided by the primary share insurer (NCUA).

You are now leaving Sooper Credit Union’s website. Although Sooper Credit Union has approved this as a reliable partner site, the linked site is not owned or controlled by the credit union. The credit union is not responsible for the availability, content, or security of the linked site. The credit union is not responsible for any claims related to any goods or services obtained from the linked site, and does not represent you or the third-party in transactions conducted via this linked website. The linked site’s privacy policies may differ from those of the credit union and the credit union is not responsible for compliance with those policies.

OK Cancel