×

×

Routing: 302076017

Routing: 302076017

Routing: 302076017

Routing: 302076017

×

×

Before creating a payroll file, be sure to create the recipient information for the individual or company you are sending money to. Once this step is complete, their information will be available on the Payments screen. If you have already completed this step, you can skip ahead to scheduling a payroll file.

Creating Recipient Information

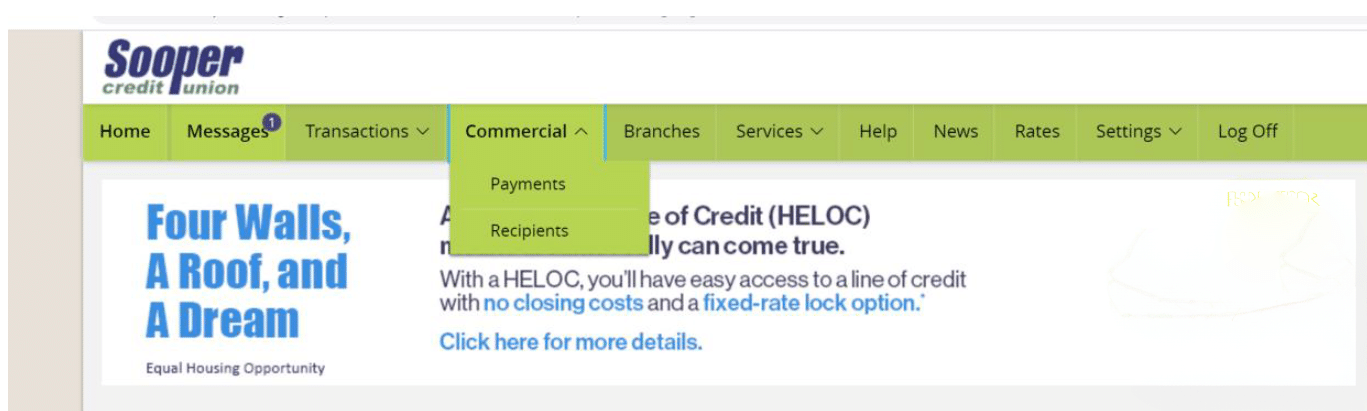

Step 1 Log into your Sooper Online Banking account.

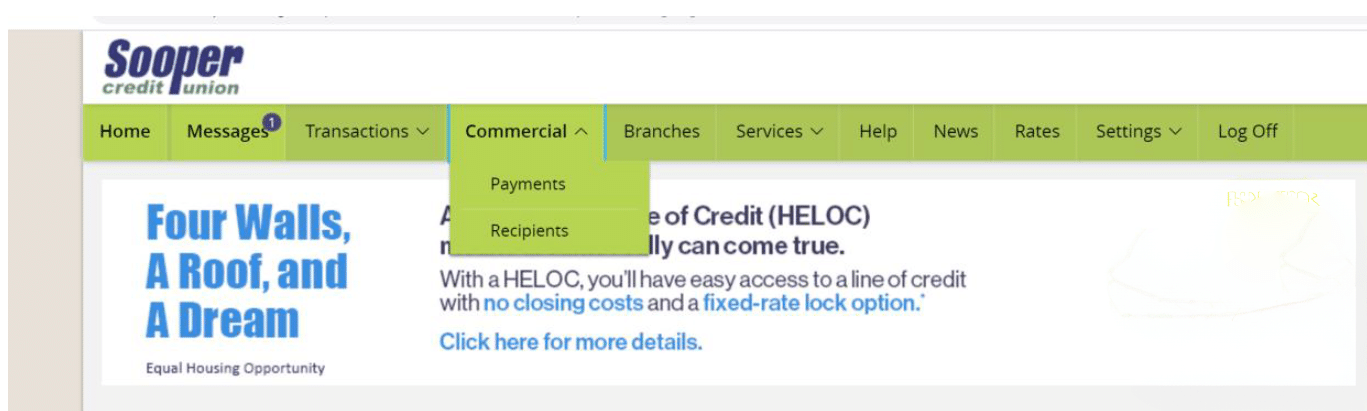

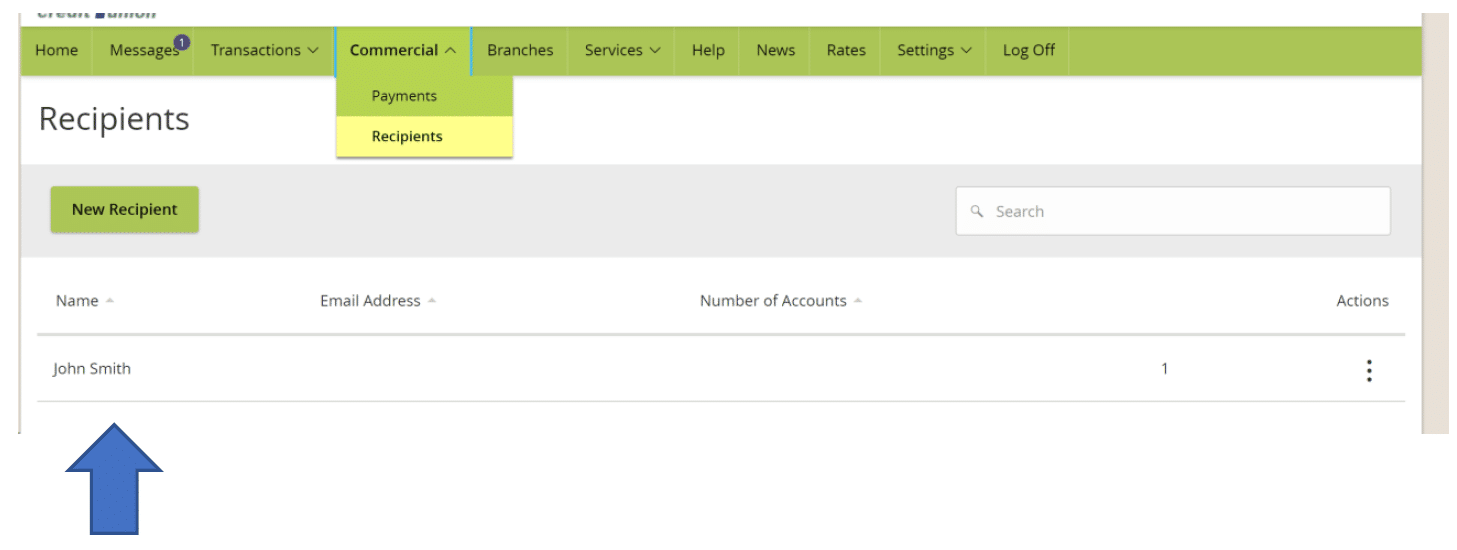

Step 2 From the Home screen, click on the Commercial tab and select Recipients from the list of options.

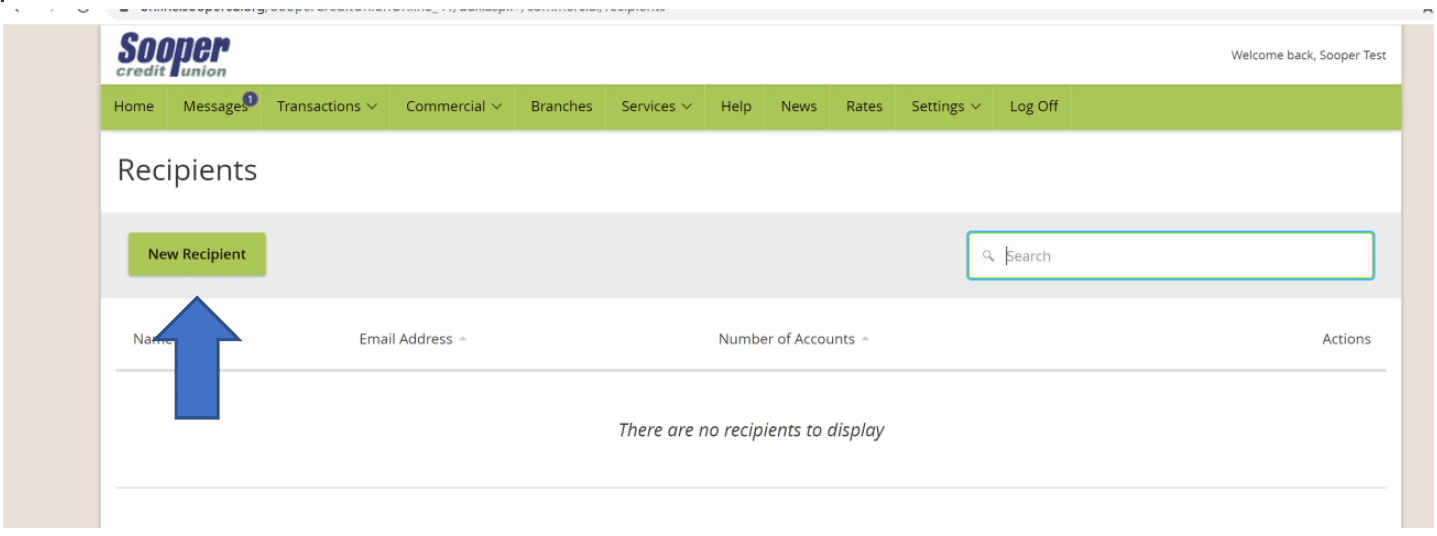

Step 3 Select the New Recipient button.

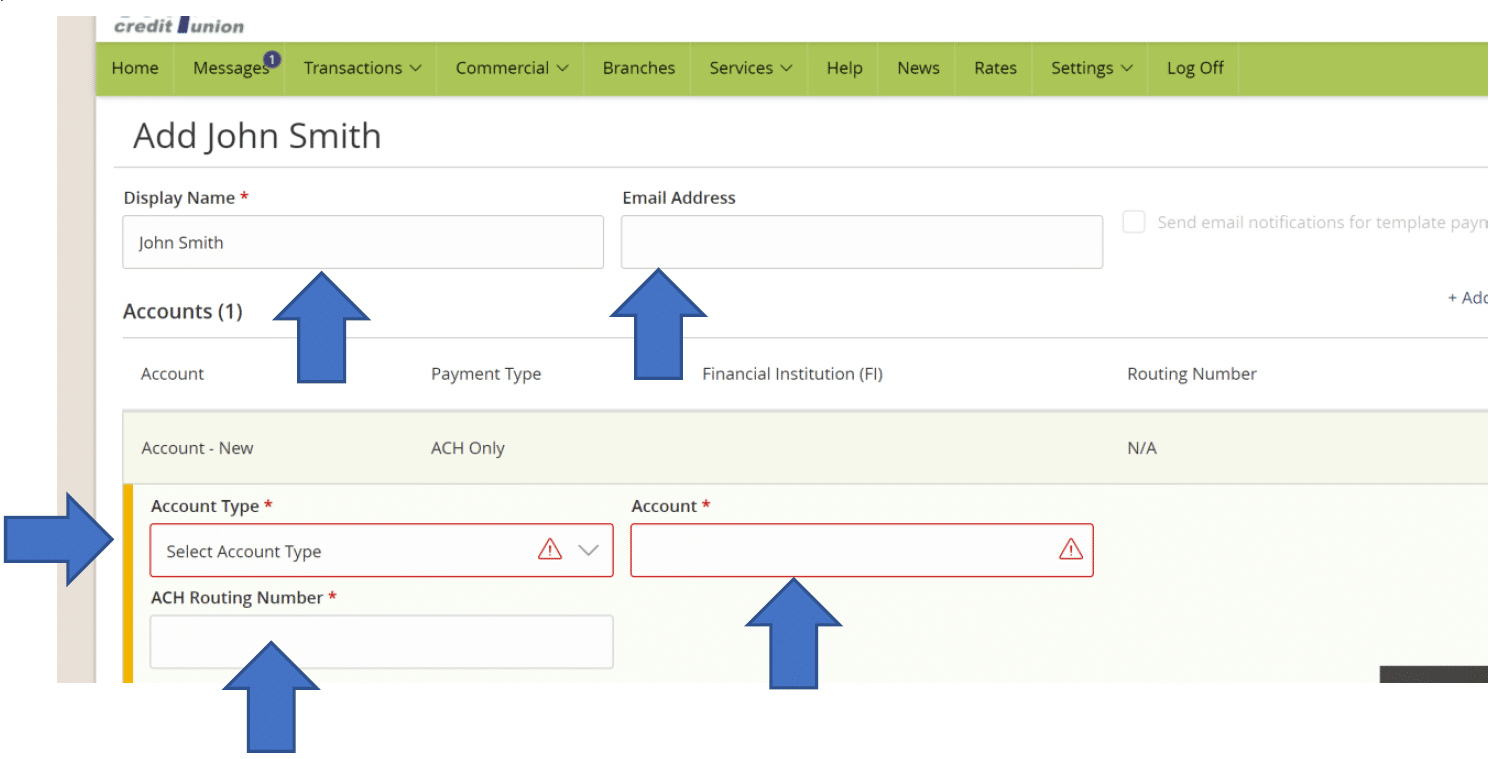

Step 4 Complete the following fields:

a. Display Name (the name of the Recipient for your records)

b. Email Address for the Recipient (if you would like to send them an email notification of the payment)

c. Account Type (type of account for the Recipient – Checking, Savings or Loan)

d. Account (account number)

e. ACH Routing Number

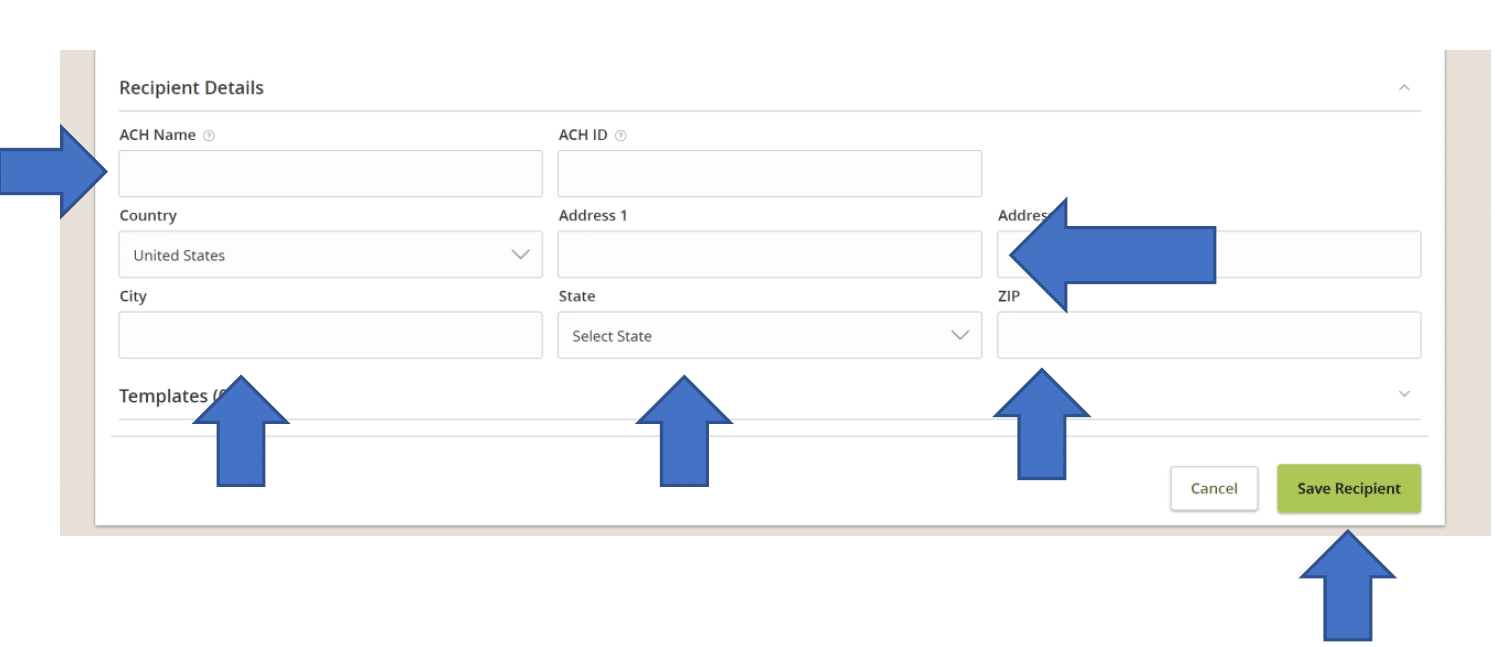

Step 5 Under the “Recipient Detail” section, complete the following fields:

a. ACH Name (the name on the receiving account)

b. Address (recipient address)

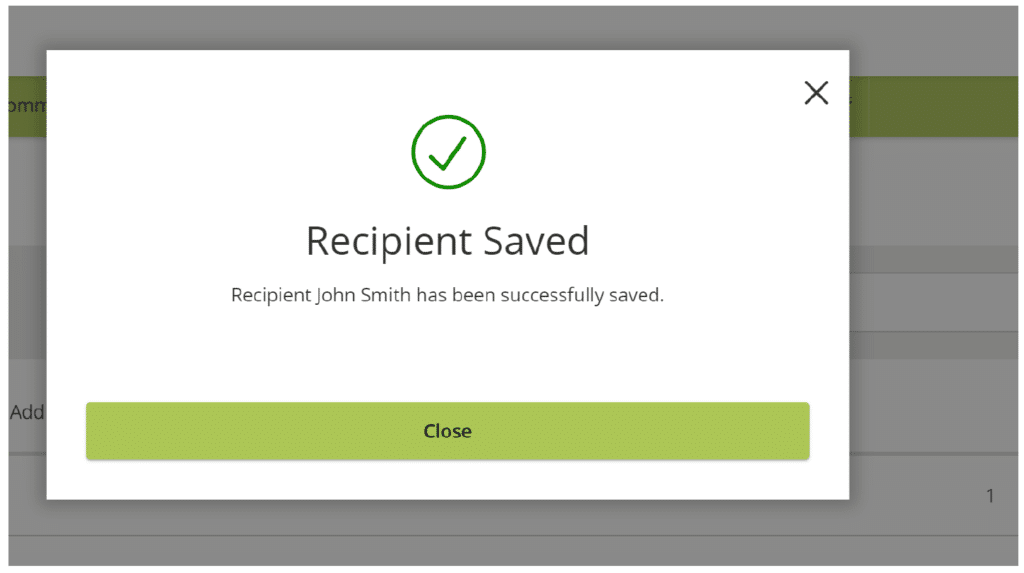

Once all fields have been completed, select Save Recipient.

Note: You can view and edit all Recipients after they have been added by clicking on the Commercial tab and then selecting Recipients.

Scheduling a Payroll Payment

Step 1 Log into your Sooper Online Banking account.

Step 2 From the Home screen, click on the Commercial tab and select Payments from the list of options.

Step 3 Select the New Payment button and then select Payroll.

Step 4 In the “Origination Details” screen, select the Account field to choose the Sooper account you want the funds to be withdrawn from. Then, select the Effective Date of the payment. Keep in mind, the cut-off time for payments is 3:00 p.m. Mountain Time.

Step 5 Under the “Recipient” section, choose the name of the Recipient you would like to pay. Then, enter the dollar amount of the payment. Continue this until you have added everyone that you would like to pay.

Step 6 Once everything is completed, review the information for a final time. Once reviewed, select Approve to process the payroll file. Payroll funds are sent via the Automated Clearing House (ACH) and may take up to 2 days to be received by the recipient.

Note: For security purposes, the transaction may be reviewed by a Sooper Credit Union representative prior to being processed in Online Banking. You will receive the following message if the file is being reviewed.

The transaction’s current status can be found by clicking on the Transactions tab and then Activity Center. If the transaction is being reviewed, it will show as “On-Hold,” if it has been approved, the status will change to “Authorized,” and once it has been processed, the status will change to “Processed.”

At Sooper Credit Union, we are committed to providing a website that is accessible to the widest possible audience in accordance with ADA guidelines. We are working to increase the accessibility and usability of our website for all users. If you are using a screen reader or other auxiliary aid and you encounter difficulties using the website, please contact us at (303) 427-5005 or (888) SOOPER1 for additional assistance. Products and services available on this website are available at our corporate office located at 5005 West 60th Ave Arvada, CO 80003.

Sooper Credit Union Copyright © 2024

Insured by NCUA | Excess Share Insurance | Equal Housing Opportunity | NMLS# 422866

The ESI program provides up to an additional $250,000 of insurance once a credit union members’ balance exceeds the coverage provided by the primary share insurer (NCUA).

You are now leaving Sooper Credit Union’s website. Although Sooper Credit Union has approved this as a reliable partner site, the linked site is not owned or controlled by the credit union. The credit union is not responsible for the availability, content, or security of the linked site. The credit union is not responsible for any claims related to any goods or services obtained from the linked site, and does not represent you or the third-party in transactions conducted via this linked website. The linked site’s privacy policies may differ from those of the credit union and the credit union is not responsible for compliance with those policies.

OK Cancel